personal loans for bad credit new york city

Add a review FollowOverview

-

Founded Date March 12, 1980

-

Sectors Software Development

-

Posted Jobs 0

-

Viewed 2

Company Description

Understanding Personal Loans with Unhealthy Credit: A Case Research

Introduction

In at present’s financial panorama, acquiring a personal loan could be a daunting task for people with a nasty credit score score. A bad credit score, usually defined as a rating beneath 580 on the FICO scale, can limit access to favorable loan phrases and even end in outright loan denials. This case examine explores the experiences of a person named Sarah, who faced challenges in securing a personal loan resulting from her unhealthy credit score, and the strategies she employed to beat these obstacles.

Background

Sarah, a 32-yr-old single mom of two, had a credit rating of 550. Her financial difficulties started several years in the past when she lost her job throughout an economic downturn. Unable to sustain along with her bills, Sarah fell behind on her bank card payments and accumulated a significant quantity of debt. Despite her efforts to stabilize her funds, her credit score rating suffered as a result of missed payments and excessive credit score utilization.

After years of working multiple jobs and steadily paying down her debts, Sarah found herself in want of a personal loan to cowl unexpected medical expenses for her kids. Together with her credit score score still in the “unhealthy” range, she was involved about her ability to secure a loan.

The Loan Search

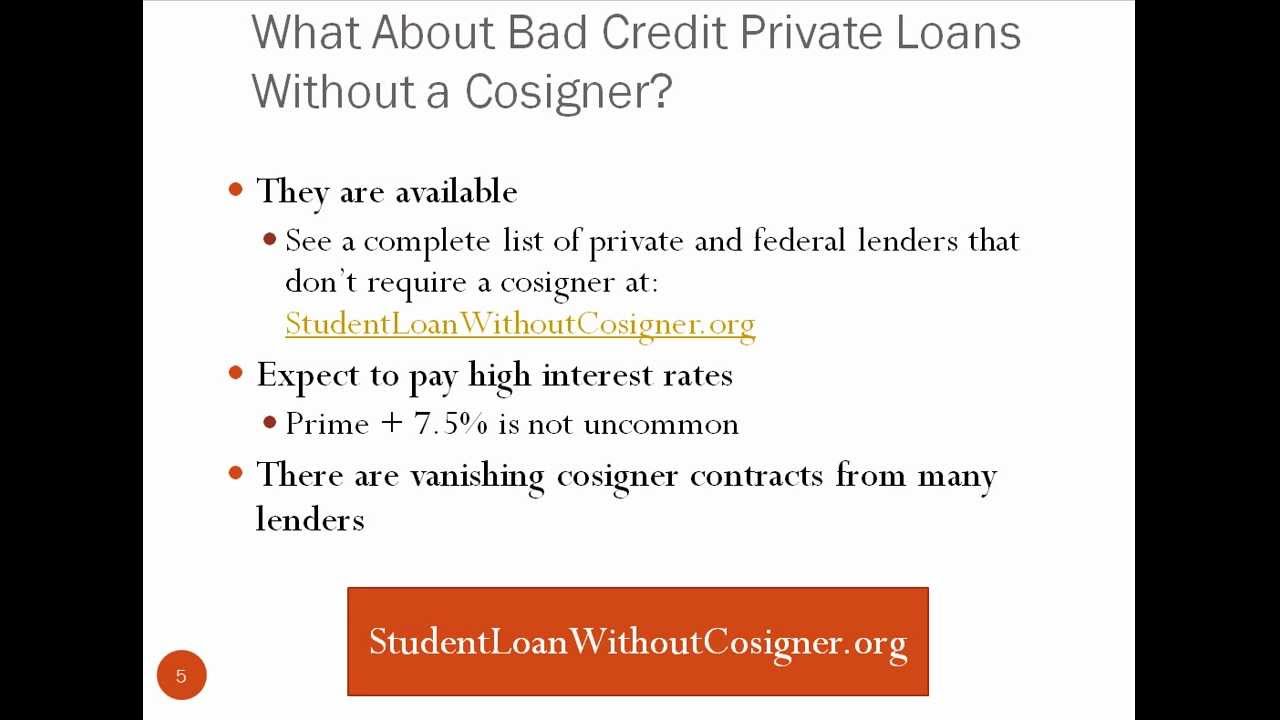

Sarah began her seek for a personal loan by researching various lenders, together with conventional banks, credit score unions, and online lenders. She rapidly discovered that many banks and credit score unions had strict lending standards, usually requiring a minimal credit rating that she didn’t meet. Moreover, those who had been willing to contemplate her software offered excessive curiosity charges that made the loans unaffordable.

Determined to search out an answer, Sarah turned to on-line lenders that specialised in loans for individuals with unhealthy credit score. Whereas a few of these lenders marketed fast approvals and minimal credit score checks, she was cautious about falling into predatory lending traps. After thorough analysis, she discovered a good online lender that provided loans specifically designed for people with less-than-excellent credit score.

Application Process

The appliance course of with the web lender was comparatively easy. Sarah accomplished the applying online, offering details about her earnings, employment, and existing debts. The lender carried out a soft credit score examine, which did not impression her credit score score. Within a number of hours, Sarah acquired a conditional approval for a loan quantity of $5,000 with a excessive curiosity charge of 25%.

While the curiosity rate was steep, Sarah weighed her choices. She calculated that the month-to-month funds could be manageable given her present revenue, and the loan would assist her cover the pressing medical expenses. After cautious consideration, she determined to accept the loan supply.

Financial Implications

Taking out the personal loan had fast financial implications for Sarah. The high interest rate meant that she would pay considerably more over the life of the loan in comparison with someone with a greater credit score. Nonetheless, Sarah was decided to make use of the loan to enhance her state of affairs. She set up a funds to ensure she may make the month-to-month funds without falling behind.

Furthermore, Sarah understood that well timed payments on this loan may positively affect her credit score. She made it a precedence to pay more than the minimal every month, aiming to scale back the principal steadiness faster and save on curiosity prices. Over the next 12 months, Sarah remained dedicated to her price range and made all her payments on time.

Results

As a result of her responsible repayment habits, Sarah’s credit score began to enhance. After one year of constant funds, her rating elevated to 620. This enchancment opened up new opportunities for Sarah. She was able to refinance her personal loan with a different lender, who offered her a lower interest charge of 15%. This not solely decreased her monthly funds but in addition the full curiosity she would pay over the life of the loan.

Along with her improved credit score, Sarah also began exploring other monetary merchandise, such as a secured bank card, to additional rebuild her credit score historical past. She learned the importance of maintaining a low credit utilization ratio and making funds on time, which might assist her continue to improve her creditworthiness.

Classes Discovered

Sarah’s expertise highlights a number of vital lessons for people with dangerous credit searching for personal loans:

- Research Lenders Thoroughly: Not all lenders are created equal. If you adored this article therefore you would like to get more info about personalloans-badcredit.com generously visit our web-site. It’s essential to research choices and find reputable lenders that cater to people with dangerous credit score without resorting to predatory practices.

- Perceive the Terms: Excessive-interest loans generally is a double-edged sword. Whereas they could present instant financial relief, they’ll result in long-term debt if not managed carefully. Understanding the terms and complete repayment amount is important.

- Budgeting is key: Creating and adhering to a budget may also help handle loan repayments and forestall further monetary pressure. Sarah’s commitment to budgeting played a significant function in her potential to repay her loan.

- Timely Funds Matter: Making timely payments can significantly affect credit score scores. People with bad credit should prioritize paying off loans to improve their creditworthiness over time.

- Discover Credit score-Constructing Options: After securing a loan, people should consider different credit score-constructing opportunities, resembling secured credit score playing cards or credit score-builder loans, to additional improve their credit profiles.

Conclusion

Sarah’s case illustrates the challenges people with bad credit score face when looking for personal loans. However, with willpower, research, and responsible financial practices, it is possible to safe a loan and enhance one’s credit score rating. By understanding the implications of borrowing and committing to a repayment plan, individuals can navigate the complexities of personal loans and work in direction of a healthier financial future.